What happened?

Back in 2019, legislation signed a law for the Washington Cares Fund. The WA Cares Act or Washington Long-term Cares Act is a tax for individuals working in Washington State. The legislation is a mandatory payroll tax of 0.58%. These benefits would be for individuals to pay for home health care, equipment, medication management, and other long term health care expense. The benefit through the state is $36,500.

When will the payroll tax go into effect?

Starting January 1st, 2022, the payroll tax will go into effect. The tax of 0.58% or $0.58 per $100 earned will be automatically deducted from your paycheck. This payroll tax includes all compensation, such as base pay, commissions, sign-on bonuses and RSUs (restricted stock units). There are some exemptions for federal workers. Self-employed workers can pay for third party policies or have funds withdrawn to pay into their Washington Long-Term Cares fund.

Is the WA Cares Act Mandatory?

Unfortunately, yes.

Should we use the state program?

If you can find an alternative provider, this is can be very beneficial. The WA Care Act limits the benefits only to be used within Washington State. By going through an alternative provider, like Transamerica, you obtain higher level of benefits (I obtained $50,000 through Transamerica) which can be used in any of the 50 states. In my case, I was able to obtain a lower cost per month through Transamerica, than through the state default. Be aware that many third party providers are inundated with new policies and some do not accept new applicants.

FYI for Transamerica LTC Policy Holders:

If you purchased a long-term care policy through Transamerica, I found out a quick tip. For all long-term care related questions, call 1-800-238-4302.

Quick Tip: Do not put in your social security number when prompted. If you do, it will default to the retirement division. Instead, if you just ignore that when you call and keep saying representative multiple times, it forces the phone system to go onto the next question. The phone will say, “what can we help you with today?”, and you need to say long-term care. When I called it was about a 1-hour wait on the phone, due to the high volume of callers.

Exemption Process:

To be honest, Washington State is barely helping anyone or giving details regarding the exemption process. Below is a step-by-step process for obtaining an exemption.

Go to www.wacaresfund.wa.gov/apply-for-an-exemption/

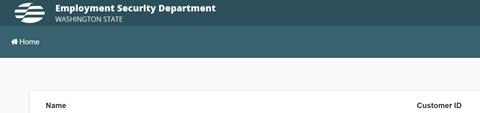

You will need to create an account via the hyperlink below or https://secureaccess.wa.gov/

Once you create an account, you will need to click on “Add New Service”

Scroll down on this list and select “Paid Family and Medical Leave” from the menu. Click OK. Click “Access Now” and click Continue.

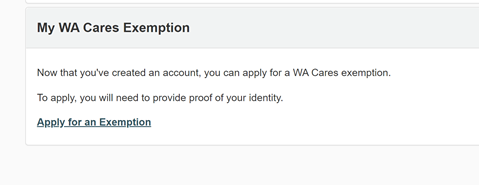

On the Paid Family and Medical Leave page, you will need to create a WA Cares Exemption account.

Click on the Apply for an Exemption hyperlink.

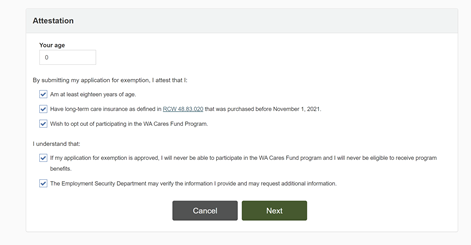

First will be an Attestation page. You must enter your age and click on all the boxes to proceed.

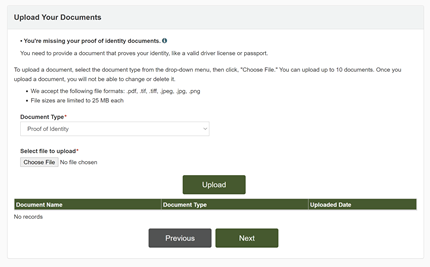

Next, you will need to enter personal data – this will include your Long-Term Cares Policy number for the third party company (it took a few weeks to get my policy in the mail with my number). Additionally, you will see a screen where you must upload a photo of your drivers license or valid passport. Once uploaded and showing at the bottom, click “Next”

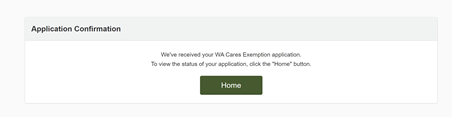

Once you hit Next, you will see an Application Confirmation

The application will process (assume this will take some time based on the volume). If your application for exemption is approved, you will obtain an approval letter. You must always keep this letter!! You will be required to present this exemption approval letter to current and future employers. If you fail to do so, you will be subject to WA Cares premiums withheld from your paycheck.

Health Savings Account Alternative:

Washington State is the first to implement the WA Cares Act (LTC). I wonder if other states are waiting to see if they should follow suit. While I think long-term care can be a beneficial program to older individuals, there are better alternatives. One option would be to allow exemption through an HSA or Health Savings Account. If one was allowed to contribute the same amount into an HSA or even additional funds, this should be a better alternative to forcing individuals to buy long-term care policies through the state default or third party insurance providers.

Cost vs. Benefit Analysis:

Let’s say you make $100,000 per year. A 0.58% payroll tax or $580 annually in this example would be taken out of ones paycheck. This is significant, because we must look at the opportunity cost. At $36,500 benefit through the state, it would take over 60 years ($36,500/$580) to breakeven.

What if we could use that same $580, and put that into a Health Saving Account and invest it? What if we could obtain a 10% annualized return?

At a 10% annualized return and contributing $580 annually, after 21 years, one would have $37,121. These funds are in an HSA, which can be for anything for health care and also, the HSA has a triple tax benefit.

For someone younger, the state should 100% allow additional HSA contributions as an alternative/exemption to their mandatory WA LTC Act.

At age 25, if you assume you won’t retire for 40 years (until age 65), at $580 per year and 10% annualized return, one would have accumulated over $256,703 in their HSA. This would WELL exceed the $36,500 benefits from the state default. Seems like a no-brainer that if states require a mandatory payroll tax for long-term care, they should offer alternatives, such as a Health Saving Account.

Concluding Thoughts:

The WA Cares Act with few alternatives, puts individuals in a tough place. While this will provide benefits for long-term care, it’s a small dollar amount of benefits and no transferability to other states, should you move. This was a state legislation, and Washington State is the test subject. Even going through a third-party insurance provider has its drawdowns.

I strongly believe one should have full control over their funds. We should have higher contribution limits to Health Savings Accounts. The Health Savings Account is the real winner for your future health care related expenses. You have full access for medical related expenses and can invest those funds to grow long term. In the meantime, if you can afford to invest in a Health Savings Account, you should! Your financial future is up to you and only you. What are you going to do about yours?

Until next time,

Zach